As every first Saturday of each month, welcome to this month’s edition of the GasTurbineHub Newsletter!

In today’s newsletter:

📈 Gas Turbine Maintenance Models – How integration became a competitive weapon.

🏭 Gas Turbine New Installations – Latest updates on projects and deployments.

⚙️ Gas Turbine Technology Developments – Innovations driving efficiency and performance.

🔥 Hydrogen Gas Turbines – Advancements in hydrogen-powered solutions.

🌍 Carbon Capture and Sequestration Projects – Key progress in reducing emissions.

📅 2025 & 2026 Events Calendar – Upcoming industry events and opportunities to connect.

Power the Mission With Us

GasTurbineHub is built on a clear purpose: to empower the gas turbine community in advancing knowledge, innovation and visibility across the industry.

To strengthen this mission, we offer one exclusive partnership at a time, a focused collaboration that gives your organisation standout visibility while directly contributing to content that moves the industry forward.

If you share our values and want to be part of a purpose-driven platform that empowers the community – partner with us.

Let’s jump right in!

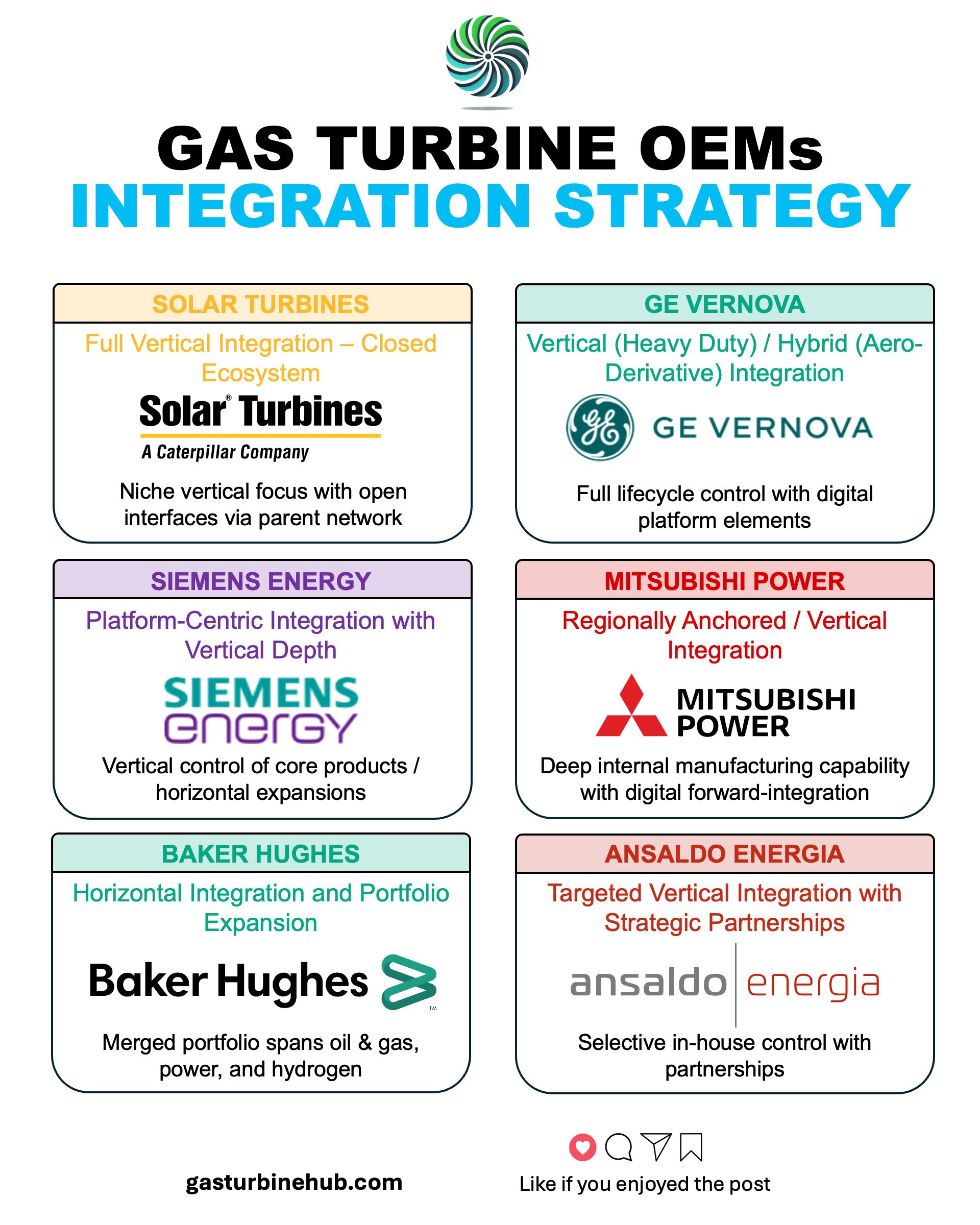

You Don’t Own the Asset if You Don’t Own the Outage

As 2026 dawns, one truth from 2025 stands out in the gas turbine sector: aftermarket service models became the battleground for OEM supremacy. In a year of surging turbine orders and tight supply chains, how OEMs serviced their installed fleets often mattered more than the shiny specs of the turbines themselves. Amid giants like GE Vernova, Siemens Energy, Mitsubishi Power, or Baker Hughes, Solar Turbines emerged as the stealth winner of the aftermarket game, leveraging a vertically integrated, fast-turnaround service approach that kept customer uptime maximised. This newsletter looks back at 2025’s service model face-off, and what Solar’s edge says about the evolving power of OEMs in the industry.

Why this matter

The gas turbine business has shifted from a build-and-sell model to build-and-serve, with aftermarket services now the primary revenue engine. Maintenance, parts, upgrades, and long-term service agreements generate stable, high-margin income that significantly exceeds new equipment sales, turning each turbine into a decades-long revenue stream. OEMs leverage lifecycle ownership through service contracts, gaining data access, fleet insights, and customer lock-in, often making services the dominant profit source during market downturns.

For operators, service reliability directly determines profitability, making uptime critical. While LTSAs provide predictability and performance guarantees, they also deepen dependence on OEMs. Independent service providers and in-house maintenance offer competitive pressure and alternatives, though OEMs still command the majority of service revenues. Overall, aftermarket strategies are strategically decisive: they underpin revenue stability, dictate plant availability, and shape the balance of power across OEMs, operators, and third parties, setting the context for why Solar Turbines’ service approach stands out.

Stakeholders implications

OEMs – Designing for lifetime value

OEMs are embedding service thinking into turbine design, not as an afterthought, but as a strategy to secure long-term customer lock-in. All major OEMs, from GE Vernova to Siemens Energy to Solar Turbines, design their service offerings to retain control and ensure recurring margin. Solar, in fact, is applying this model to its extreme.

GE Vernova and Siemens Energy operate global service networks underpinned by long-term service agreements (LTSAs) and performance guarantees. Their aftermarket models emphasise data-driven maintenance, leveraging digital twins, fleet-wide analytics, and predictive diagnostics. These programs offer strong technical depth, but rely heavily on the coordination of regional repair centers, distributed parts logistics, and field teams, factors that introduced fragility during 2025’s supply chain constraints. Their models are structured, but not always agile.

Baker Hughes emphasises modularity and digital services but operates with less scale in the large-frame segment. Its aftermarket approach is more hybrid, blending OEM support with third-party collaboration, especially in older or diversified fleets. Mitsubishi Power and Ansaldo Energia pursue a mix of internal service capabilities and external partnerships, often focused on their installed base or regional strongholds.

Solar Turbines, by contrast, maintains end-to-end control over its aftermarket process. It manufactures, monitors, services, and exchanges its turbines through a vertically integrated, closed-loop model. The engine exchange system allows customers to swap in a fully overhauled unit within 48 hours, minimising downtime and simplifying planning. While this model limits customer flexibility and excludes third parties, it proved structurally robust in 2025. Solar could absorb disruption better than others because it owned the process from inventory to installation.

The lesson isn’t that Solar is more controlling, it’s that its control was structurally more effective when predictability and speed mattered most. In a market where uptime is currency, the ability to execute fast, consistent service became the competitive edge.

End users – Uptime vs. lock-in

Operators face a strategic trade-off. OEM service plans minimise downtime and align with performance goals, but they also create dependency. Solar offered best-in-class uptime with fast engine exchanges, giving users confidence and continuity. Its proactive health monitoring and fleet-wide engineering upgrades gave customers the sense that they weren’t just being serviced, but strategically supported.

GE and Siemens brought scale, outcome guarantees, and digital intelligence to the table. Their contracts, especially on HA and F-class fleets, emphasised availability, heat rate, and emissions performance. But the size and complexity of their fleets, coupled with aging assets and varied legacy configurations, meant more variables to manage. As supply chains tightened in 2025, operators learned the risks of over-reliance on a single provider and saw the costs of inflexible turnaround times. Solar’s ability to deliver consistent, low-friction service raised expectations across the sector. More operators began questioning whether their OEMs should offer similar exchange-based solutions, especially in mid-sized or modular turbine classes.

Independent Service Providers – Niche Under Pressure

ISPs are being squeezed by OEM strategies. With OEMs controlling intellectual property, digital twins, and embedded analytics, and signing LTSAs at the point of turbine sale, ISPs find less room to compete. Still, they remain a vital check. For aging fleets, older frame models, or customers outside long-term contracts, ISPs can offer flexible terms and lower costs, while maintaining high-quality.

Some ISPs have found opportunity in supporting operators who want hybrid models: OEM parts with third-party labor, or OEM overhauls augmented by local field crews. But their long-term viability increasingly hinges on specialisation, agility, and credibility. The more OEMs vertically integrate, and the more their service models resemble Solar’s tight loop, the narrower the window for ISPs to add value.

Strategy takeaways

-

Service = strategic control: OEMs that dominate service capture, customer relationships, margin, and long-term leverage. In 2025, service was the real profit engine.

-

Continuity was the differentiator: Solar stood out in a disrupted year because it had planned for disruption. Inventory, logistics, and modularity were not afterthoughts, they were the core offer.

-

Modularity is market power: Fast-turnaround designs (like Solar’s) are becoming a competitive advantage. OEMs that enable quick swaps rather than drawn-out rebuilds will increasingly set the standard.

-

Customer leverage is shifting: Outcome-based contracts gave users more negotiating room. But the best negotiating position came from proven uptime, not clauses on paper.

-

Independents must specialise: ISPs need to focus on niche capabilities, coatings, controls, retrofits, that OEMs overlook or deprioritise. The generalist ISP model is under pressure.

Looking ahead: Solar Turbines didn’t win the aftermarket by accident, it’s been playing a different game from the start. This wasn’t a pivot or a response; it’s how they were built. Whether or not they anticipated this kind of market pressure, their model has proven to be the answer. In 2026, the question is whether other OEMs will redesign their service DNA to compete, or keep leaning on monopoly muscle, hoping stable demand hides structural fragility. What’s clear is this: once customers are forced to look elsewhere, they might not come back.

References: Solar Turbines service literature; GasTurbineHub Aftermarket Report; GE and Siemens service documentation; Baker Hughes press announcements.

Join the conversation: Sign up for our newsletter to stay updated on developments in gas turbine technology and the energy sector.

The Latest News in a Snapshot

Gas Turbine New Installations

-

Entergy Louisiana Builds 1.5 GW Gas Plants for Meta Data Center

“Groundbreaking took place in Richland Parish, LA, for two combined-cycle plants (~1,500 MW) to power Meta’s massive AI data center. The project includes three gas turbines, a 10,000-acre solar farm, and carbon sequestration to offset ~60% of emissions from the gas units.“

Source: Entergy (1 December, 2025) -

China Commissions First Locally-Made 400 MW Gas Turbine

“China Energy Investment Corp began operation of the Anji power plant with two advanced gas turbines (~400 MW each) made in China. Co-developed by GE Vernova and Harbin Electric, these H-class units are China’s first domestically manufactured heavy-duty turbines, reducing reliance on imports amid a global equipment shortage.“

Source: ChinaDaily.com (1 December, 2025) -

Georgia Power receives turbine and generator for new Unit 9 at Plant Yates

“Georgia Power received a Mitsubishi M501JAC gas turbine and generator for Unit 9 of Plant Yates (Coweta County, GA). Three such J-class turbines (total ~1,300 MW) are being installed by 2027 to replace former coal units. The fast-start turbines can fire on natural gas (with oil backup) and are designed for future hydrogen blending.“

Source: Georgia Power (15 December, 2025) -

Doosan Enerbility Signs Agreement with Major U.S. Tech Company to Supply Three Gas Turbines

“Doosan Enerbility announced on December 17th that it had signed an agreement with a leading U.S. technology company to supply three 380MW gas turbines. Doosan will be supplying the gas turbines and generators to be used at a data center that is being built by the tech company. The first delivery, consisting of one gas turbine and one generator, will be made in 2027, while the second delivery consisting of another set of gas turbines and generators, two of each, is to be made in 2028.“

Source: Doosan Enerbility (17 December, 2025) -

Hungary Repowers Mátra Plant with Hydrogen-Ready GT26

“A consortium building the new Mátra CCGT in Hungary awarded Ansaldo Energia a contract for one GT26 gas turbine and one steam turbine generator. The F-class unit (~500–600 MW in combined-cycle) will run at ~60% efficiency with flexible load capability, and can ramp quickly while being ready for hydrogen fuel blends without derating.“

Source: Ansaldo Energia (18 December, 2025)

Gas Turbine Technology and Market Developments

-

NextEra Energy and Google Cloud Expand Strategic Partnership for AI-Driven Data Center and Energy Infrastructure Growth

“NextEra Energy and Google Cloud announced an expanded collaboration to jointly develop multiple gigawatt-scale data center campuses across the United States, integrating Google Cloud’s AI capabilities into NextEra’s energy infrastructure operations to accelerate digital transformation and support expanded energy and data demand.“

Source: NextEra Energy (8 December, 2025) -

GE Vernova Logs 80 GW Gas Turbine Backlog

“GE’s turbine manufacturing is at capacity after signing 18 GW of orders in Q4 alone. Big Tech data centers now comprise ~⅓ of its US gas power deals, and GE is booking out into 2029 while preparing hydrogen-ready upgrades.“

Source: GE Vernova (9 December, 2025) -

PSM Expands US Turbine Service Hub

“Hanwha’s PSM opened a major expansion of its Stuart, FL facility to boost gas turbine upgrade manufacturing and repairs. The new plant adds advanced capacity and jobs, positioning PSM to meet growing retrofit demand for lower-emission, high-flexibility turbine solutions.“

Source: PSM (11 December, 2025) -

MHI & Mitsubishi Electric Demo Next-Gen GT Controls

“The companies completed testing of a next-gen gas turbine control system that enables fast load changes for renewables and multi-fuel use (natural gas/hydrogen). Market launch is set for 2026 to support hydrogen-capable, highly flexible GT plants.“

Source: Mitsubishi Power (24 December, 2025)

Hydrogen Gas Turbines

-

China launches operation of the world’s first 30 MW-class gas turbine running exclusively on hydrogen

“The world’s first 30 MW pure hydrogen-fueled turbine, “Jupiter I,” achieved stable operation in Inner Mongolia. This demo project integrates wind, solar, and electrolysis to store excess power as hydrogen and generate electricity with zero carbon emissions, avoiding an estimated 200,000 tons of CO₂ annually.“

Source: hydrogen-central.com (30 December, 2025) -

China launches operation of the world’s first 30 MW-class gas turbine running exclusively on hydrogen

“The world’s first 30 MW pure hydrogen-fueled turbine, “Jupiter I,” achieved stable operation in Inner Mongolia. This demo project integrates wind, solar, and electrolysis to store excess power as hydrogen and generate electricity with zero carbon emissions, avoiding an estimated 200,000 tons of CO₂ annually.“

Source: hydrogen-central.com (30 December, 2025)

Carbon Capture and Sequestration Projects

-

Capsol to deploy first carbon capture on U.S. gas turbines

“Norway’s Capsol Technologies signed an MoU with a major U.S. utility to equip a simple-cycle gas power plant with its CapsolGT® CO₂ capture system, capturing 95% of emissions.“

Source: Capsol (8 December, 2025)

Gas Turbine Related Events Happening in 2025 and 2026

GPPS Turbomachinery Seminar 2026

Date: January 12–13, 2026

Location: Zurich, Switzerland (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-turbomachinery-seminar-2026/

GPPS Energy & Aviation Forum26

Date: January 14–15, 2026

Location: Zurich, Switzerland (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-forum26/

II Seville Forum on Machinery for Decarbonization

Date: January 20, 2026

Location: Seville, Spain (In-person)

Organizer: University of Seville

Website: https://eventos.us.es/133965/detail/ii-seville-forum-on-machinery-for-decarbonization.html

POWERGEN International 2026

Date: January 20-22, 2026

Location: San Antonio, Texas (In-person)

Organizer: POWERGEN International

Website: https://www.powergen.com

PROENERGY Annual Conference

Date: January 26–28, 2026

Location: Phoenix, Arizona (In-person)

Organizer: PROENERGY

Website: https://www.proenergyservices.com/about-us/user-conference/

18th Annual PSM Asset Managers Conference

Date: January 26–30, 2026

Location: Jupiter, Florida (In-person)

Organizer: PSM

Website: https://psm.eventsair.com/amc2026/registrationmain

Baker Hughes Annual Meeting 2026

Date: January 28–30, 2026

Location: Florence, Italy (In-person)

Organizer: Baker Hughes

Website: https://annualmeeting.bakerhughes.com

26th Annual 501F & 501G Users Group Conference 2026

Date: February 15–20, 2026

Location: Norfolk, Virginia (In-person)

Organizer: 501F & 501G Users Group

Website: https://forum.501fusers.org/static-pages/page/conference/1

Frame 5 / 6B / 7E / 9E User Group Meeting 2026

Date: February 17–19, 2026

Location: Ludwigshafen, Germany (In-person)

Organizer: ETN Global

Website: https://etn.global/events/frame-user-group-meeting-2026/

FT8 / FT4 User Groups 2026

Date: March 17–19, 2026

Location: Charlotte, North Carolina (In-person)

Organizer: FT8 / FT4 User Groups

Website: www.ft8users.com / www.ft4users.com

Western Turbine Users (WTUI) Conference 2026

Date: April 7–10, 2026

Location: Long Beach, California (In-person)

Organizer: Wester Turbine Users

Website: https://wtui.com

V94.2 (SGT5-2000E AE94.2) Users Conference 2026

Date: April 20–23, 2026

Location: Helsinki, Finland (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com/conferences

SGT800 Users Conference 2026

Date: May 11–13, 2026

Location: Stuttgart, Germany (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com/conferences

13th GTF Gas Turbine Focus Conference and Exhibition

Date: May 12–14, 2026

Location: Shanghai, China (In-person)

Organizer: CDMC

Website: https://expopromoter.com/events/178891/

7F User Groups Annual Conference

Date: May 18–22, 2026

Location: The Woodlands, Texas (In-person)

Organizer: TPS

Website: https://www.powerusers.org/our-groups/7f-users-group/

Asia Turbomachinery & Pump Symposia (TPS) 2026

Date: May 19–21, 2026

Location: Kuala Lumpur, Malaysia (In-person)

Organizer: TPS

Website: https://atps.tamu.edu