As every first Saturday of each month, welcome to this month’s edition of the GasTurbineHub Newsletter!

In today’s newsletter:

📈 2025: Market Rewired – Decline → Rebirth → Bottleneck.

🏭 Gas Turbine New Installations – Latest updates on projects and deployments.

⚙️ Gas Turbine Technology Developments – Innovations driving efficiency and performance.

🔥 Hydrogen Gas Turbines – Advancements in hydrogen-powered solutions.

🌍 Carbon Capture and Sequestration Projects – Key progress in reducing emissions.

📅 2025 & 2026 Events Calendar – Upcoming industry events and opportunities to connect.

Power the Mission With Us

GasTurbineHub is built on a clear purpose: to empower the gas turbine community in advancing knowledge, innovation and visibility across the industry.

To strengthen this mission, we offer one exclusive partnership at a time, a focused collaboration that gives your organisation standout visibility while directly contributing to content that moves the industry forward.

If you share our values and want to be part of a purpose-driven platform that empowers the community – partner with us.

Let’s jump right in!

A Year That Shifted the Ground Beneath Us

As we close the final GasTurbineHub newsletter of 2025, the moment calls for a sober reflection. This year was not simply a continuation of previous trends; it was a structural shift, the kind that creeps up quietly and only reveals its scale when we look back.

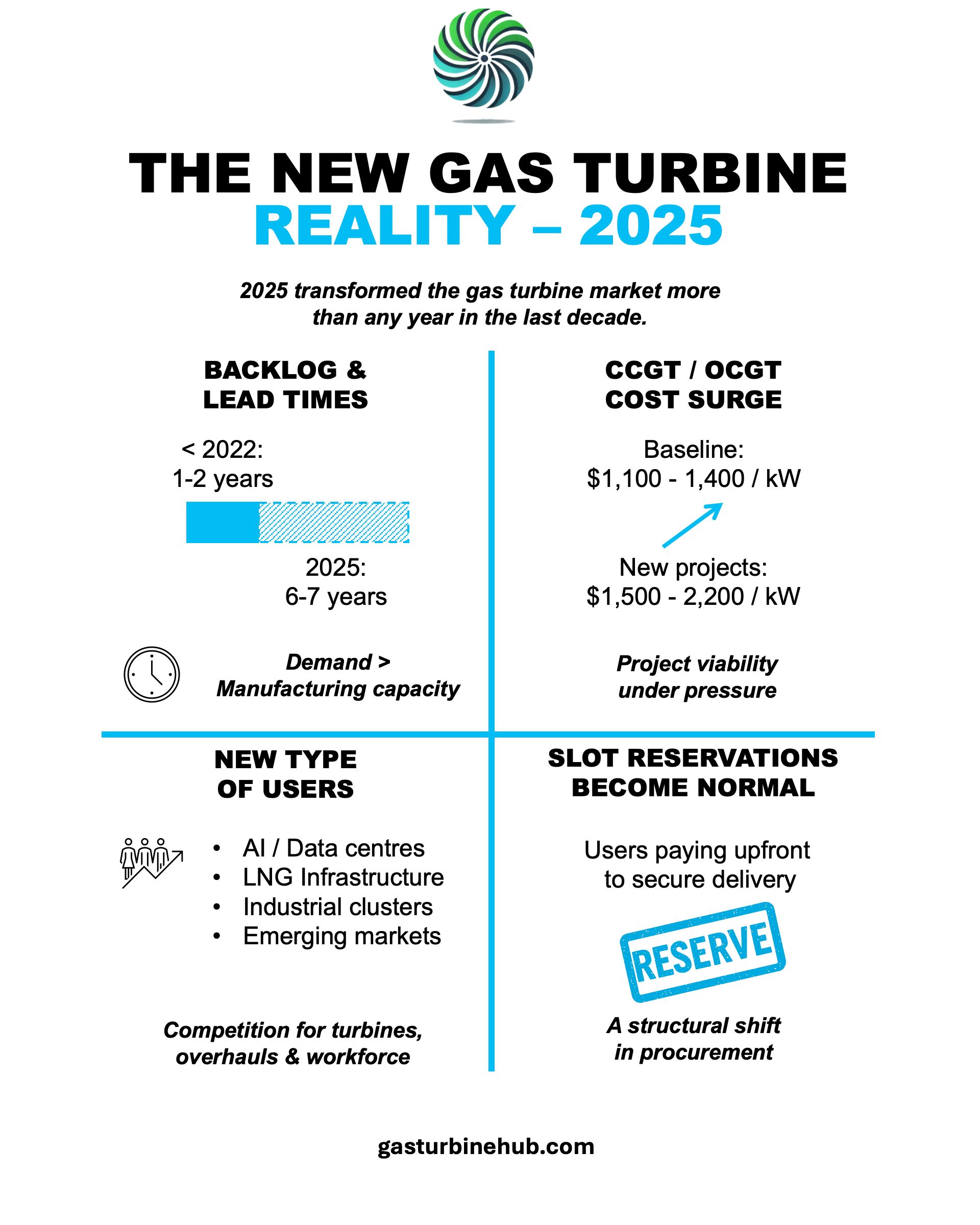

Just two years ago, the sector was emerging from supply-chain disruption, inflationary pressure, and subdued order books. In 2024, demand began to accelerate, driven by energy security concerns and early signals of data-center-led load growth. But no one, not even experienced planners, fully anticipated what 2025 would become: a year defined by unprecedented OEM backlogs, six-to-seven-year delivery horizons, sharply rising CCGT and OCGT costs, and a new behaviour from users, paying for slot reservations, just to ensure a place in the queue.

This year marks a turning point. Not because turbines became different, but because the market conditions around them did. And this shift forces us to ask harder questions about the next decade:

How should the industry adapt? Who benefits? Who falls behind? And are we prepared for the consequences of a capacity-constrained future?

To understand 2025, we must first understand what drove it.

Drivers Behind the Structural Shift

1. AI and power generation: a demand profile not one planned for

AI-driven data centres have reshaped gas turbine procurement in 2025. Global data-centre consumption reached 650–800 TWh and could triple by 2030 (IEA, 2024). In the U.S., load requests of 7–10 GW per year are overwhelming grid planners (DOE, 2023).

Hyperscalers aren’t waiting for grid upgrades, with connection queues of 5–8 years in key markets (IEA, 2025), they’re building private microgrids. Turbines offer the only dispatchable, scalable, 12–24 month solution.

This demand is qualitatively new:

-

Reliability is contractual, with outages costing millions per hour.

-

Load grows exponentially, sometimes 50–70% per year (IEA, 2025).

-

Energy procurement is strategic, not operational.

The centre of gravity is shifting from utilities to digital infrastructure as the new dominant offtaker.

2. LNG markets reinforcing the need for flexible generation

2025 underscored a new reality: LNG markets are volatile. Prices swung from $9 to $16/MMBtu over the 2024–2025 winter (Kpler, 2025), while Europe’s LNG dependence exceeded 60% of imported gas (IEA, 2025).

In this environment, gas turbines are no longer a “bridge”; they’re risk management. Efficiency and flexibility are becoming financial assets:

-

Each percentage point of efficiency saves $5–10 million per year on a 600-MW CCGT.

-

Ramping capability of 30–50 MW/min helps operators survive price swings.

Even with EPC costs rising 20–30% since 2021, investment continues because efficiency equals margin when LNG volatility is the norm.

3. Emerging markets: ambition vs. constraints

Emerging markets planned more than 50 GW of gas-to-power additions in 2025 (IEA, 2025), but reality intervened:

-

Turbine lead times stretched to 24–36+ months.

-

EPC bids rose 25–40%.

-

Multiple projects slipped by 12–24 months.

They face a paradox: Gas turbines are essential for grid stability, yet global demand is delaying access to the technology they rely on.

The strategic choices for 2026 are becoming clear: secure manufacturing slots early, diversify technologies, or risk multi-year delays in national energy planning.

How the Market Has Changed – And How It Affects Each Stakeholder

1. OEMs: Strong demand, but strategic vulnerability beneath the surface

OEMs enter 2026 with full order books, rising service revenue, and strong visibility. But this stability hides a strategic risk. Users still overwhelmingly prefer OEM service, it remains their primary source of support. Yet when OEMs cannot deliver on time, users are forced to turn elsewhere.

And every time that happens, the door opens a little wider for independent service providers and alternative technology suppliers.

This is not an immediate threat today, demand is high, margins are comfortable, and the installed base is growing. But our sector is cyclical. When the cycle turns, OEMs may find that the years of long lead times and delayed service delivery have unintentionally cultivated stronger competition and pricing pressure in their own aftermarket.

In the long term, the current backlog may strengthen OEM balance sheets, but weaken customer dependency, a risk worth acknowledging as the industry moves into 2026.

2. Service Providers: Temporary opportunity, long-term risk

With new units delayed and OEM pipelines saturated, the installed fleet has become the centre of gravity for 2025’s aftermarket activity. Independent service providers are experiencing exceptional demand: life-extension work, component upgrades, field services, and interim maintenance bridging the long wait for new equipment.

But this surge is temporary. Users still prefer OEM service, and many will return once OEM capacity recovers. For independents, the only defence is quality and partnership. One-off transactions won’t survive the next market cycle. Long-term relationships and consistently high-quality delivery are the only way to remain relevant when OEMs regain bandwidth.

3. Users: Forced Into Long-Term Commitments Amid New Competitive Pressures

End-users are the most directly exposed to this new market reality. Paying reservation fees, almost unheard of a few years ago, shows how strategic turbine access has become. Users must now commit earlier, plan over longer horizons, carry higher upfront exposure, and accept that project economics are driven as much by timing as by technology.

But an additional shift is emerging: new types of users are entering the market. AI-driven data centres, LNG infrastructure, and large industrial clusters are now competing directly with utilities and traditional operators — not only for new turbines and overhaul slots, but increasingly for skilled workforce as well.

This competition tightens the market across the entire value chain, raising costs, stretching timelines, and creating asymmetry between users who can secure long-term commitments and those who cannot.

4. Policy Makers: A year of decisions that now constrain the transition

For policymakers, 2025 exposed a growing disconnect between ambition and physical reality. After years of sidelining gas turbines, treating them as politically inconvenient rather than strategically essential, policy frameworks bet almost exclusively on “non-dispatchable” technologies. Yet experts repeatedly warned that without flexible dispatchable capacity, renewable expansion would eventually hit a ceiling.

That ceiling arrived faster than expected.

Instead of strengthening the grid with modern gas turbines while scaling renewables, we now face a situation where adding more renewable energy is constrained by the inability to add more dispatchable power. With 6–7-year lead times and soaring CCGT/OCGT costs, policymakers have unintentionally delayed the very transition they sought to accelerate.

It may look contradictory to deploy conventional-fuel gas turbines today, but these assets are the structural foundation that enables higher shares of renewables tomorrow. Ignoring this reality does not accelerate decarbonisation, it stalls it.

The industry is ready to deliver. The bottleneck is not engineering. It is policy misalignment with system needs.

5. Research & innovation organisations: the only actors still building the future

Research and innovation institutions hold a uniquely important role in today’s gas turbine landscape. Unlike OEMs and service providers, currently absorbed by delivery, backlog management, and short-term commercial priorities, R&I teams are not driven by quarterly margins or revenue pressures.

And that is precisely what makes their contribution indispensable.

Because they are free from the commercial urgency of “selling,” they can focus entirely on technology development, deep investigation, and increasing TRL levels for the solutions society will expect from gas turbines in the next 10–15 years: true hydrogen capability, advanced materials, breakthrough efficiency improvements, carbon-ready configurations, and innovative low-impact combustion concepts.

These institutions are the guardians of the long term, the only part of the ecosystem still investing full focus into what gas turbines must become to remain relevant in a decarbonised future.

What the Industry Should Focus on in 2026

Looking ahead, 2026 will be a year of strategic choices, not only about technology, but about the structural direction of the entire gas turbine ecosystem. Four areas stand out.

-

Scale manufacturing wisely: OEMs must expand capacity without overextending. Too little expansion locks in bottlenecks; too much risks oversupply by the early 2030s.

-

Shorten deployment pathways: with 6–7-year lead times, the sector needs faster options: modular aeroderivatives, hybrid gas–battery systems, distributed clusters, and strategic life-extension of existing fleets.

-

Stabilise project economics: rising CCGT/OCGT costs demand clearer capacity-market signals, predictable permitting, long-term hydrogen policy, and accessible transition finance if new builds are to remain viable.

-

Plan decarbonisation around real timelines: hydrogen co-firing, CCS, and hybridisation must align with longer procurement cycles. Transition strategies must reflect asset maturity, not idealised retrofit timelines.

Looking Ahead: 2025 showed us that gas turbines are now shaped more by manufacturing constraints and system pressures than by pure technology. In 2026, the industry must confront this reality directly, balancing ambition with feasibility, or risk letting structural bottlenecks define the next decade.

References: IEA (2024). Electricity Demand from Data Centres and AI. DOE (2023). Electricity Demand from Data Centers. IEA (2025). Electricity 2025: Executive Summary. Kpler (2025). Global LNG Market Outlook 2025.

Join the Conversation: Sign up for our newsletter to stay updated on developments in gas turbine technology and the energy sector.

The Latest News in a Snapshot

Gas Turbine New Installations

-

1,200-megawatt natural gas power plant and utility-scale solar planned by FirstEnergy

“West Virginia: Planned 1,200 MW Gas+Solar Plant – FirstEnergy proposed a 1.2 GW combined-cycle gas plant (with 70 MW solar) in WV to replace coal, slated for 2029 operation. The project promises lower costs and 60% fewer emissions than coal, supporting WV’s “50 by 50” energy growth goal.“

Source: FirstEnergy (6 November, 2025) -

Taiwan Petrochemical Plant Orders Second H-25 Gas Turbine

“Chang Chun Petrochemical ordered a second 30 MW Mitsubishi H-25 turbine to replace aging coal/oil-fired boilers at its Miaoli facility. The cogeneration upgrade will provide power and steam, reduce CO₂ emissions, and enhance energy efficiency in Taiwan’s industrial sector by 2028.“

Source: MHI (12 November, 2025) -

Blackstone to Build 600 MW Hydrogen-Ready CCGT in West Virginia

“Blackstone Energy Infrastructure announced the 600 MW Wolf Summit Energy CCGT project in Harrison County, WV. The facility will use a hydrogen-ready GE 7HA.02 turbine and serve Old Dominion Electric Co-op. It will be West Virginia’s first advanced gas plant, online by 2028.“

Source: Blackstone (13 November, 2025) -

Chevron chooses West Texas as the site for its first natural gas–powered data center facility

“Chevron’s 2.5 GW Off-Grid Plant – Chevron announced plans for a 2,500 MW gas-fired plant in Pecos, TX to directly power energy-hungry data centers (bypassing the grid). First power is expected in 2027, with potential expansion to 5 GW, reflecting booming AI-related demand.“

Source: DataCenterDynamics (14 November, 2025) -

GE Vernova to provide H-Class combined cycle equipment for Enea Group’s Kozienice Power Station in Poland

“With a start of operations scheduled in 2029, the new gas-fired plant, which will include two 9HA.01, is expected to deliver approximately 1.2 gigawatts (GW) of electricity to the national power system and generate up to 60% lower emissions compared to a coal-fired plant of similar size.“

Source: GE Vernova (18 November, 2025) -

Baker Hughes Delivers 1.3 GW of Mobile Aeroderivative Gas Turbines

“Baker Hughes secured a large order for 25 aeroderivative turbines (LM2500, LM6000, LM9000 models) from Dynamis Power Solutions. The mobile fleet will supply fast-deployable gas power (~1.3 GW) for oil & gas sites. A highlight is the “DT70” solution using ten LM9000s to deliver 700 MW.“

Source: Baker Hughes (20 November, 2025) -

Orange County Advanced Power Station Nears Completion in Texas

“Entergy Texas announced its Orange County Advanced Power Station is over 80% built. The 1,215 MW hydrogen-capable CCGT plant will replace aging units and support regional demand growth. Online in 2026, it will be among the first to blend 30% H₂ from launch.“

Source: Entergy (21 November, 2025)

Gas Turbine Technology and Market Developments

-

Constellation targets 5.8 GW of new gas, nuclear and battery storage in Maryland

“Constellation Energy unveils a major investment plan including new quick-deploy gas turbines. Over 700 MW of natural gas capacity is proposed that can be installed rapidly and later converted to burn hydrogen fuel. By designing these units as hydrogen-ready, the plan aims to ensure the added gas generation can transition to zero-carbon operation in the future.“

Source: Constellation (4 November, 2025) -

ABB and Ansaldo Energia partnership completes gas turbine control system modernisation

“Ansaldo Energia has completed the project to modernize Unit 1 of the Modugno combined cycle power plant owned by Sorgenia. The plant, located near the city of Bari in Southern Italy, has a nominal power rate of 810 MW. As part of this project, ABB has evolved the plant’s existing gas turbine control systems to the latest ABB Ability™ System 800xA® technology.“

Source: ABB (11 November, 2025) -

Vertiv and Caterpillar Announce Energy Optimization Collaboration to Expand End-to-End Power and Cooling Offerings for AI Data Centers

“Announced a strategic collaboration to pre-package gas turbines + cooling for hyperscale data centers. Solar Turbines (Cat) will supply gas turbines/engines for on-site generation, Vertiv provides modular power & cooling blocks. Goal: shorten deployment, improve PUE and reliability for AI data centers facing grid delays.”

Source: Vertiv Holdings (18 November, 2025) -

Texas Approves Fast-Track Loans for New Hydrogen-Ready Gas Plant

“The Texas Energy Infrastructure Fund approved a loan for a 455 MW fast-start gas turbine project near Houston. Designed to blend hydrogen in the future, it addresses grid reliability and is part of the state’s strategic investments in dispatchable, future-proof power infrastructure.“

Source: Office of the Texas Governor (20 November, 2025) -

Idemitsu & Overwatch to Deploy 1 GW of Onsite Gas Turbines for AI Centers

“Idemitsu Kosan and Overwatch Capital will build AI-optimized data centers with up to 1 GW of onsite gas turbines and battery storage across 10 U.S. states. The initiative combines natural gas generation, thermal management, and on-demand computing in a modular, fast-deployable architecture.“

Source: Idemitsu (21 November, 2025)

Hydrogen Gas Turbines

-

LADWP Approves $800M Hydrogen-Capable Retrofit at Scattergood Station

“LADWP approved modernization of two legacy gas units at Scattergood Station with hydrogen-ready combined-cycle turbines. The $800M project will deliver 840 MW capacity by 2029, beginning with 30% green hydrogen and progressing toward 100%, supporting LA’s 100% clean energy goal by 2035.“

Source: Hydrogen-Central (10 November, 2025)

Carbon Capture and Sequestration Projects

-

Toshiba + GE Vernova team up on GTCC carbon capture

“Toshiba Energy and GE Vernova signed an MoU to integrate GE’s turbine EGR system with Toshiba’s solvent CO₂-capture technology in combined-cycle gas plants. Goal: cut emissions ~90% with less efficiency loss, targeting retrofits in Japan/Asia.“

Source: Toshiba (6 November, 2025) -

UK’s Uniper Launches Carbon-Capture Gas Plant Plan at Killingholme

“Uniper began consultation on a 720 MW gas power plant with integrated carbon capture in North Killingholme. Linked to the East Coast Cluster, the plant will deliver low-carbon dispatchable energy while cutting emissions from fossil sources. A formal application is expected in 2026.“

Source: Uniper (11 November, 2025) -

Completion of a CO2 Separation and Capture Demonstration Facility at Kobe Works, Accelerating the Development of CO2 Capture Operations

“Kawasaki Heavy Industries commissioned a CO₂-capture demo facility at Kobe, with post-combustion capture on a gas engine plant plus direct air capture. It will trap low-concentration CO₂ from exhaust, advancing KHI’s carbon capture tech for power applications.“

Source: Kawasaki Heavy Industries (12 November, 2025) -

NET Power & Entropy to build CCS gas hubs

“Why Net Power is adding post-combustion capture to its suite of carbon capture solutions? An interview with Net Power President & CEO, Danny Rice.“

Source: NET Power (24 November, 2025)

Gas Turbine Related Events Happening in 2025 and 2026

Gas Turbine Users Forum (GTUF) Summer 2025 Conference and Training

Date: December 2–4, 2025

Location: Brisbane, Australia (In-person)

Organizer: GTUF

Website: https://gtuf.au/news/gtuf-summer-2025-conference/

GPPS Turbomachinery Seminar 2026

Date: January 12–13, 2026

Location: Zurich, Switzerland (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-turbomachinery-seminar-2026/

GPPS Energy & Aviation Forum26

Date: January 14–15, 2026

Location: Zurich, Switzerland (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-forum26/

II Seville Forum on Machinery for Decarbonization

Date: January 20, 2026

Location: Seville, Spain (In-person)

Organizer: University of Seville

Website: https://eventos.us.es/133965/detail/ii-seville-forum-on-machinery-for-decarbonization.html

POWERGEN International 2026

Date: January 20-22, 2026

Location: San Antonio, Texas (In-person)

Organizer: POWERGEN International

Website: https://www.powergen.com

PROENERGY Annual Conference

Date: January 26–28, 2026

Location: Phoenix, Arizona (In-person)

Organizer: PROENERGY

Website: https://www.proenergyservices.com/about-us/user-conference/

18th Annual PSM Asset Managers Conference

Date: January 26–30, 2026

Location: Jupiter, Florida (In-person)

Organizer: PSM

Website: https://psm.eventsair.com/amc2026/registrationmain

Baker Hughes Annual Meeting 2026

Date: January 28–30, 2026

Location: Florence, Italy (In-person)

Organizer: Baker Hughes

Website: https://annualmeeting.bakerhughes.com

26th Annual 501F & 501G Users Group Conference 2026

Date: February 15–20, 2026

Location: Norfolk, Virginia (In-person)

Organizer: 501F & 501G Users Group

Website: https://forum.501fusers.org/static-pages/page/conference/1

Frame 5 / 6B / 7E / 9E User Group Meeting 2026

Date: February 17–19, 2026

Location: Ludwigshafen, Germany (In-person)

Organizer: ETN Global

Website: https://etn.global/events/frame-user-group-meeting-2026/

Western Turbine Users (WTUI) Conference 2026

Date: April 7–10, 2026

Location: Long Beach, California (In-person)

Organizer: Wester Turbine Users

Website: https://wtui.com

V94.2 (SGT5-2000E AE94.2) Users Conference 2026

Date: April 20–23, 2026

Location: Helsinki, Finland (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com/conferences

SGT800 Users Conference 2026

Date: May 11–13, 2026

Location: Stuttgart, Germany (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com/conferences

13th GTF Gas Turbine Focus Conference and Exhibition

Date: May 12–14, 2026

Location: Shanghai, China (In-person)

Organizer: CDMC

Website: https://expopromoter.com/events/178891/

7F User Groups Annual Conference

Date: May 18–22, 2026

Location: The Woodlands, Texas (In-person)

Organizer: TPS

Website: https://www.powerusers.org/our-groups/7f-users-group/

Asia Turbomachinery & Pump Symposia (TPS) 2026

Date: May 19–21, 2026

Location: Kuala Lumpur, Malaysia (In-person)

Organizer: TPS

Website: https://atps.tamu.edu