As every first Saturday of each month, welcome to this month’s edition of the GasTurbineHub Newsletter!

In today’s newsletter:

📈 Aftermarket empire – Steady services ensure resilience.

🏭 Gas Turbine New Installations – Latest updates on projects and deployments.

⚙️ Gas Turbine Technology Developments – Innovations driving efficiency and performance.

🔥 Hydrogen Gas Turbines – Advancements in hydrogen-powered solutions.

🌍 Carbon Capture and Sequestration Projects – Key progress in reducing emissions.

📅 2025 & 2026 Events Calendar – Upcoming industry events and opportunities to connect.

What’s Next for GasTurbineHub?

Last month, we asked our followers what type of content would bring the most value to industry experts. The response was clear, gas turbine data and specifications topped the list, followed by industry insights, event updates, and market snapshots.

We’re taking this valuable feedback to shape the next stage of GasTurbineHub’s content. Stay tuned, exciting developments are on the way.

Let’s jump right in!

In the gas turbine business, the spotlight often shines on the big announcements: new unit sales, plant openings, and record-breaking efficiency ratings. Yet behind every headline turbine lies a quieter truth: the real power in this industry is not in selling machines, but in keeping them running.

The aftermarket, the vast ecosystem of maintenance, repair, overhaul, parts supply, and upgrades, has quietly become the sector’s financial backbone. It is where margins live, where customer relationships are forged, and where technological innovation actually meets the field.

Unlike new equipment sales, which follow cyclical investment patterns, aftermarket demand is steady, predictable, and growing. Every turbine installed becomes a decades-long revenue stream, a living asset that requires care, expertise, and continuous optimisation.

The Scale of the Invisible Giant

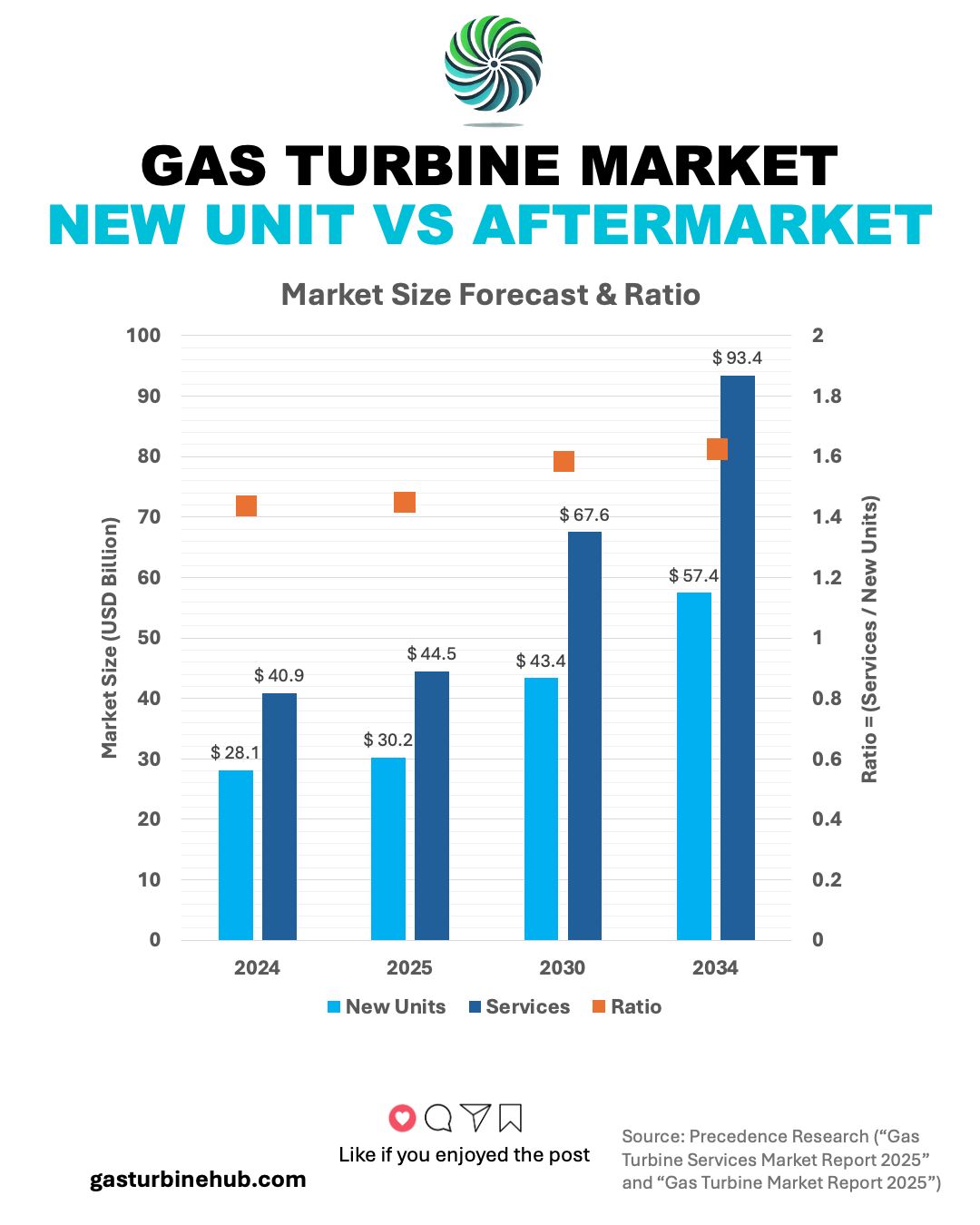

The numbers tell a compelling story. While annualised new equipment orders for gas turbines are valued at $15–24 billion in 2024 [1], the global aftermarket services market is nearly double that, valued at $40.9 billion in 2024 and projected to reach $44.5 billion in 2025 [2]. This is not an outlier, it’s the norm.

In fact, between now and 2034, the world is expected to spend $261 billion on gas turbine services, compared to $137 billion in new turbine orders, a more conservative forecast [1]. The data is unequivocal: the gas turbine business model is no longer build-and-sell, it’s build-and-serve. Meanwhile, a more aggressive growth trajectory suggests that by 2034, new unit sales could reach $38.1 billion and aftermarket services could reach $89.9 billion in that year alone [2].

The Business of Lifecycle Dominance

Here’s the truth: what truly drives investment and sustains balance sheets is not the volatility of new equipment sales, but the predictable, bankable revenue of the aftermarket. Long-Term Service Agreements (LTSAs) and their surrounding services create steady income streams that act as a financial anchor for OEMs and Independent Service Providers (ISPs).

This is how major manufacturers weather the sharp cycles of turbine sales: when orders drop, services continue. In fact, in downturn years, aftermarket revenues can represent the lion’s share of income and margins.

OEMs know this well. Securing LTSAs is not just about cash flow, it’s about strategic positioning. Owning the lifecycle gives them leverage: data access, fleet insights, and a customer lock-in model that protects them from commoditisation.

ISPs challenge this dominance. And not quietly. ISPs are increasingly essential players, not just to end-users, but to OEMs themselves. Some OEMs source parts or services from the very third parties they compete with downstream. ISPs thrive on flexibility, cost competitiveness, and niche agility. Their growth is a signal: operators want more than just one option.

For end-users, this diversity isn’t just nice to have, it’s essential. A healthy mix of service providers reduces lock-in risks, creates pricing leverage, and shields critical operations from OEM capacity bottlenecks. In an environment of long lead times and supply chain uncertainty, being tied to a single provider can be dangerous. More suppliers mean more resilience. And right now, resilience is strategic.

What’s Driving Demand: Grid Gaps, Data Centers, and Aging Fleets

The aftermarket isn’t growing in a vacuum. It’s being driven by major macro trends:

-

Grid reliability needs have made gas turbines essential peakers in renewables-heavy systems.

-

Data centers are placing huge new baseload demands, often installing on-site gas turbines with multiyear LTSA support.

-

Emerging markets are ramping up turbine orders, orders that will feed future service demand.

-

Europe is retrofitting and overhauling its gas fleet as coal exits.

Meanwhile, OEMs can barely keep up. Global orders are surging: 2025 is expected to see 964 gas turbine units ordered worldwide, up from 471 in 2024, the highest level since 2011 [1]. This boom locks in decades of future aftermarket growth.

How the Market Splits: By Region and Service Type

Aftermarket value isn’t evenly spread. Asia-Pacific leads the global services market, accounting for 40% of service revenue, followed by North America (28%) and Europe (22%) [2]. Asia benefits from a large and growing installed base, while Europe is projected to grow fastest due to decarbonization retrofits, hydrogen-readiness, and coal phase-outs.

Latin America and the Middle East & Africa have smaller shares, but both regions are expanding rapidly as new builds go into operation and OEMs localize service operations.

By service type, spare parts dominate, about 64% of the market in 2024, reflecting the ongoing need for hot-section components [2]. Overhaul and repair services are expected to grow fastest, driven by aging fleets and digital optimization. By provider type, OEMs currently capture 62% of service revenues, but this share is steadily eroding due to the rise of ISPs and in-sourcing. Meanwhile, the non-OEM segment is projected to grow rapidly during the forecast period.

By end-use, power generation accounts for more than 68% of service market revenue in 2024 [2], a testament to how essential gas turbines remain in dispatchable grid capacity.

Is the Surge in Turbine Sales a Liftoff or a Spike?

With turbine orders surging in 2025 and 2026, a key question emerges: What will this mean for the aftermarket?

On one hand, it promises a larger installed base, new LTSAs, and decades of service revenue. On the other, it raises concerns: is this a sustainable inflection point, or a hype-driven spike?

History suggests a pattern: in every major technology cycle, euphoria leads to overcapacity, then a rational correction, followed by a more stable and elevated plateau.

So: are aftermarket stakeholders preparing for the long game? Are OEMs, ISPs, and operators making the right investments now, in skills, infrastructure, digital tooling, to absorb this future wave of demand?

And crucially, will this create space for new entrants and business models? Ones that challenge the status quo with modularity, AI, transparency, and customer-first economics?

The answer isn’t obvious. But the question is critical. Because the turbines of 2025 won’t just need fuel. They’ll need a whole ecosystem that’s ready to serve them.

Looking Ahead: Gas turbine OEMs are retooling for a services-centric future. Backlogs are ballooning. Lead times for large turbines now stretch up to 7 years. In response, Gas turbine OEMs are ramping up production, not just to sell turbines, but to capture the downstream services windfall.

And they’re right to do so. The turbines sold in 2025 and 2026 will still be spinning, and earning, in 2050.

This transformation aligns with themes explored in previous editions of Gas Turbine Hub:

-

The Growing Backlog of Gas Turbine Orders: Implications for Customers

-

Second Half of 2025: Regional Markets, OEM Moves, and What’s Ahead

The message is clear: if you want to understand the power structure of the gas turbine industry, don’t follow the megawatts. Follow the maintenance.

References: [1] Gas Turbine World, 2025 Market Forecast Revision. [2] Precedence Research, “Gas Turbine Services Market Report 2025”.

Join the Conversation: Sign up for our newsletter to stay updated on developments in gas turbine technology and the energy sector.

The Latest News in a Snapshot

Gas Turbine New Installations

-

Siemens Energy to supply ten gas turbines to Xcel Energy as electric demand increases in Texas and New Mexico

“ Xcel Energy has purchased 10 large gas turbines and associated generation equipment from Siemens Energy to support construction of two power plants. The investment comes as electric demand surges across the region, driven by evolving energy needs and the planned retirement of Xcel Energy’s Tolk Station. The new facilities will add 2,088 megawatts of dispatchable generation capacity, ensuring flexible, on-demand power during peak usage and volatile market conditions.“

Source: Siemens Energy (1 October, 2025) -

ST Engineering and Siemens Energy Awarded Contract for 2nd Floating Power Plant in Dominican Republic

“ Contract signed for a Siemens Energy power barge with 2× SGT-800 gas turbines + 1× steam turbine + Li-ion battery. Will be delivered in 2028 to Santo Domingo, augmenting grid capacity with a high-efficiency, barge-based CCGT.“

Source: ST Engineering (17 October, 2025) -

PacificLight Appoints a Consortium of Mitsubishi Power and Jurong Engineering Limited to build 670 MW CCGT Power Plant in Singapore

“ PacificLight Power Pte Ltd has awarded an Engineering, Procurement, and Construction (EPC) contract to a consortium comprising Mitsubishi Power and Jurong Engineering Limited for the country’s largest and most efficient CCGT facility. Expected to be operational in 2029, it will be hydrogen-ready and capable of supporting Singapore’s decarbonization targets.“

Source: Mitsubishi Power (23 October, 2025) -

GE Vernova aeroderivative gas turbine solutions to power Isaac Power Station in Australia

“GE Vernova today announced that it secured an order from the Australian independent gas producer and energy company QPM Energy Limited for two of its LM6000 aeroderivative gas packages. GE Vernova’s fuel flexible aeroderivative gas turbine packages are aimed to enable the plant to use QPM’s existing gas reserves or coal mine waste gas (with at least 50% methane) that it collects.“

Source: GE Vernova (23 October, 2025) -

Advanced Power’s 640 MW Maple Creek Development Secures GE Vernova H-Class Equipment, Accelerating Development Timeline

“Located in MISO Zone 6, Maple Creek will deploy the 7HA.03 gas turbine, generator and associated equipment to deliver approximately 640 megawatts (MW) of reliable, dispatchable electricity, enough to power more than 630,000 homes in the United States by 2029.“

Source: Maple Creek Energy (27 October, 2025)

Gas Turbine Technology and Market Developments

-

Ansaldo Energia Successfully Completes The Upgrade Of Alpiq’s San Severo Power Plant

“Ansaldo Energia upgraded Alpiq’s 400 MW plant, adding 43 MW and enabling 25% hydrogen co-firing. Efficiency improved ~1%, CO₂ cut by 10k t/yr, enhancing grid flexibility in southern Italy.“

Source: Ansaldo Energia (2 October, 2025) -

Doosan Enerbility Secures First Overseas Export of Gas Turbine to U.S. Market

“On October 13th, Doosan Enerbility announced that it had signed an agreement with a prominent U.S. technology company to provide two units of Doosan’s 380MW gas turbines. The two gas turbines are to be delivered by Doosan Enerbility by the end of next year.“

Source: Doosan Enerbility (13 October, 2025) -

Capstone Green Energy And Microgrids 4 Ai Announce 800 Vdc On-Site Power To Chip Next-Generation Ai Infrastructure

“The Capstone 800 VDC natural gas microturbine represents a natural extension of its existing inverter-based power electronics technology. The 800 VDC is designed to directly interface with the forthcoming Kyber and Rubin Ultra platforms. The system will eliminate multiple AC/DC conversion stages, reduce copper mass by up to 45%, and improve overall power efficiency by as much as 5% compared to legacy 54V systems.“

Source: Capstone Green Energy (21 October, 2025) -

Vistra Completes Acquisition of Seven Natural Gas Plants, Expanding Diverse Generation Fleet

“Vistra oday announced it has completed the acquisition of seven modern natural gas generation facilities totaling approximately 2,600 MW of capacity from Lotus Infrastructure Partners. The transaction closing follows receipt of all required regulatory approvals.“

Source: Vistra (22 October, 2025) -

GE Vernova reports third quarter 2025 financial results and reaffirms guidance

“Strong 3Q’25 results with robust orders and backlog, continued margin expansion and positive free cash flow.“

Source: GE Vernova (22 October, 2025) -

GE Vernova inaugurates its first repair center for enhanced aero-derivative gas turbine support in southern Latin America

“A new GE Vernova repair service center has opened in Argentina to support outage needs in Argentina, Brazil, Chile and Uruguay.“

Source: GE Vernova (23 October, 2025) -

Baker Hughes Company Announces Third-Quarter 2025 Results

“The company reported orders of $8.2 billion, including $4.1 billion from Industrial & Energy Technology (IET). Remaining Performance Obligations (RPO) reached $35.3 billion, with a record IET RPO of $32.1 billion. Revenue totaled $7.0 billion, up 1% year-over-year, while attributable net income was $609 million. GAAP diluted EPS stood at $0.61, with adjusted diluted EPS* of $0.68. Adjusted EBITDA* amounted to $1,238 million, reflecting a 2% year-over-year increase. Cash flows from operating activities were $929 million, and free cash flow* reached $699 million.“

Source: Baker Hughes (23 October, 2025) -

EMA to Award Up to $44 Million to Operators of the First Two Advanced Combined Cycle Gas Turbines

“To help lower the carbon emissions of power plants, the Energy Market Authority (EMA) will award up to $44 million under the Advanced Combined Cycle Gas Turbine (CCGT) Incentive Scheme to operators of the first two advanced CCGTs in Singapore, Keppel’s Infrastructure Division and Sembcorp Industries (Sembcorp). The scheme is part of efforts to encourage the adoption of advanced CCGTs to improve the power sector’s generation efficiency and reduce carbon emissions.“

Source: EMA (27 October, 2025)

Hydrogen Gas Turbines

-

Ground broken on test site for cutting edge 100% hydrogen fired turbines

“The state-of-the-art test facility is being extended as part of SSE, Siemens Energy and Equinor’s multi-million pound “Mission H2 Power” collaboration. This will allow testing and validation of combustion components of the largest gas turbines, enabling them to run on 100% hydrogen.“

Source: SSE (3 October, 2025) -

Kawasaki Plant’s Hydrogen Co-Firing Gas Turbine Project Selected for METI’s “Support Project for Energy and Manufacturing Process Conversion in Hard-to-Abate Industries

“the Kawasaki Plant operates two in-house power generation systems (boilers and turbines) primarily fueled by petroleum coke. Under the Project, one system will be decommissioned and replaced with a city gas/hydrogen co-firing gas turbine*1, with operations scheduled to begin in the first quarter of 2030.“

Source: Resonac (24 October, 2025) -

RWE Voerde (Germany) – 850 MW H₂-Ready CCGT

“RWE chose Técnicas Reunidas + GE to develop a new combined-cycle plant able to co-fire 50% H₂ at start (2030) and eventually 100%. Part of Germany’s strategy to replace coal with hydrogen-capable gas units (subject to tender awards).“

Source: RWE (27 October, 2025) -

GE Vernova 9HA technology will power YTL PowerSeraya’s new hydrogen capable power plant in Singapore

“GE Vernova to provide a H-class combined cycle equipment for Pulau Seraya Power Station operated by YTL PowerSeraya Pte. The new power plant is expected to deliver up to 600 megawatts (MW) to the national grid in 2027.“

Source: GE Vernova (28 October, 2025) -

LADWP approves hydrogen blend conversion at Scattergood plant

“Los Angeles DWP board approved modernizing two units of Scattergood Generating Station. New combined-cycle turbines will start by burning a blend of natural gas and at least 30% green hydrogen, with the goal of 100% hydrogen as supply grows. The project will replace old units (due by 2029) and is pitched as essential to LA’s 100% renewable goal.“

Source: Los Angeles Times (29 October, 2025) / LASWP Project Overview

Carbon Capture and Sequestration Projects

-

Post-Combustion Carbon Capture Feasibility Study in Singapore

“GE Vernova and YTLPowerSeraya Pte Limited announced today the collaboration of the two companies on a feasibility study to analyze the lowering of carbon emissions of YTLPS’ H-Class Combined Cycle Gas Turbine (CCGT) plant on Jurong Island, Singapore.“

Source: GE Vernova (27 October, 2025) -

Texas Backs Permian Gas-Fired Power Plant With $1.1 Billion Loan as AI Demand Soars

“$1.1 B state loan for CPV’s Permian CCGT (GE turbines, CCUS-ready) to ensure grid reliability amid AI-driven load growth.“

Source: Energy Connects (30 October, 2025)

Gas Turbine Related Events Happening in 2025 and 2026

SGT-A35 (Industrial RB211) User Group Meeting 2025

Date: November 4–6, 2025

Location: Pau, France (In-person)

Organizer: ETN Global (Host – TotalEnergies)

Website: https://etn.global/events/sgt-a35-user-group-meeting-2025/

GT26 Users Conference 2025

Date: November 10–13, 2025

Location: Istanbul, Turkey (In-person)

Organizer: GTUsers

Enlit Europe

Date: November 18–20, 2025

Location: Bilbao, Spain (In-person)

Organizer: Enlit

Website: https://www.enlit-europe.com

Gas Turbine Users Forum (GTUF) Summer 2025 Conference and Training

Date: December 2–4, 2025

Location: Brisbane, Australia (In-person)

Organizer: GTUF

Website: https://gtuf.au/news/gtuf-summer-2025-conference/

GPPS Energy & Aviation Forum26

Date: January 14–15, 2026

Location: Zurich, Switzerland (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-forum26/

II Seville Forum on Machinery for Decarbonization

Date: January 20, 2026

Location: Seville, Spain (In-person)

Organizer: University of Seville

Website: https://eventos.us.es/133965/detail/ii-seville-forum-on-machinery-for-decarbonization.html

PROENERGY Annual Conference

Date: January 26–28, 2026

Location: Phoenix, Arizona (In-person)

Organizer: PROENERGY

Website: https://www.proenergyservices.com/about-us/user-conference/

18th Annual PSM Asset Managers Conference

Date: January 26–30, 2026

Location: Jupiter, Florida (In-person)

Organizer: PSM

Website: https://psm.eventsair.com/amc2026/registrationmain

Baker Hughes Annual Meeting 2026

Date: January 28–30, 2026

Location: Florence, Italy (In-person)

Organizer: Baker Hughes

Website: https://annualmeeting.bakerhughes.com

26th Annual 501F & 501G Users Group Conference 2026

Date: February 15–20, 2026

Location: Norfolk, Virginia (In-person)

Organizer: 501F & 501G Users Group

Website: https://forum.501fusers.org/static-pages/page/conference/1

Frame 5 / 6B / 7E / 9E User Group Meeting 2026

Date: February 17–19, 2026

Location: Ludwigshafen, Germany (In-person)

Organizer: ETN Global

Website: https://etn.global/events/frame-user-group-meeting-2026/