As every first Saturday of each month, welcome to this month’s edition of the GasTurbineHub Newsletter!

In today’s newsletter:

📈 R&D Expenditure – Looking beyond billions.

🏭 Gas Turbine New Installations – Latest updates on projects and deployments.

⚙️ Gas Turbine Technology Developments – Innovations driving efficiency and performance.

🔥 Hydrogen Gas Turbines – Advancements in hydrogen-powered solutions.

🌍 Carbon Capture and Sequestration Projects – Key progress in reducing emissions.

📅 2025 & 2026 Events Calendar – Upcoming industry events and opportunities to connect.

Let’s jump right in!

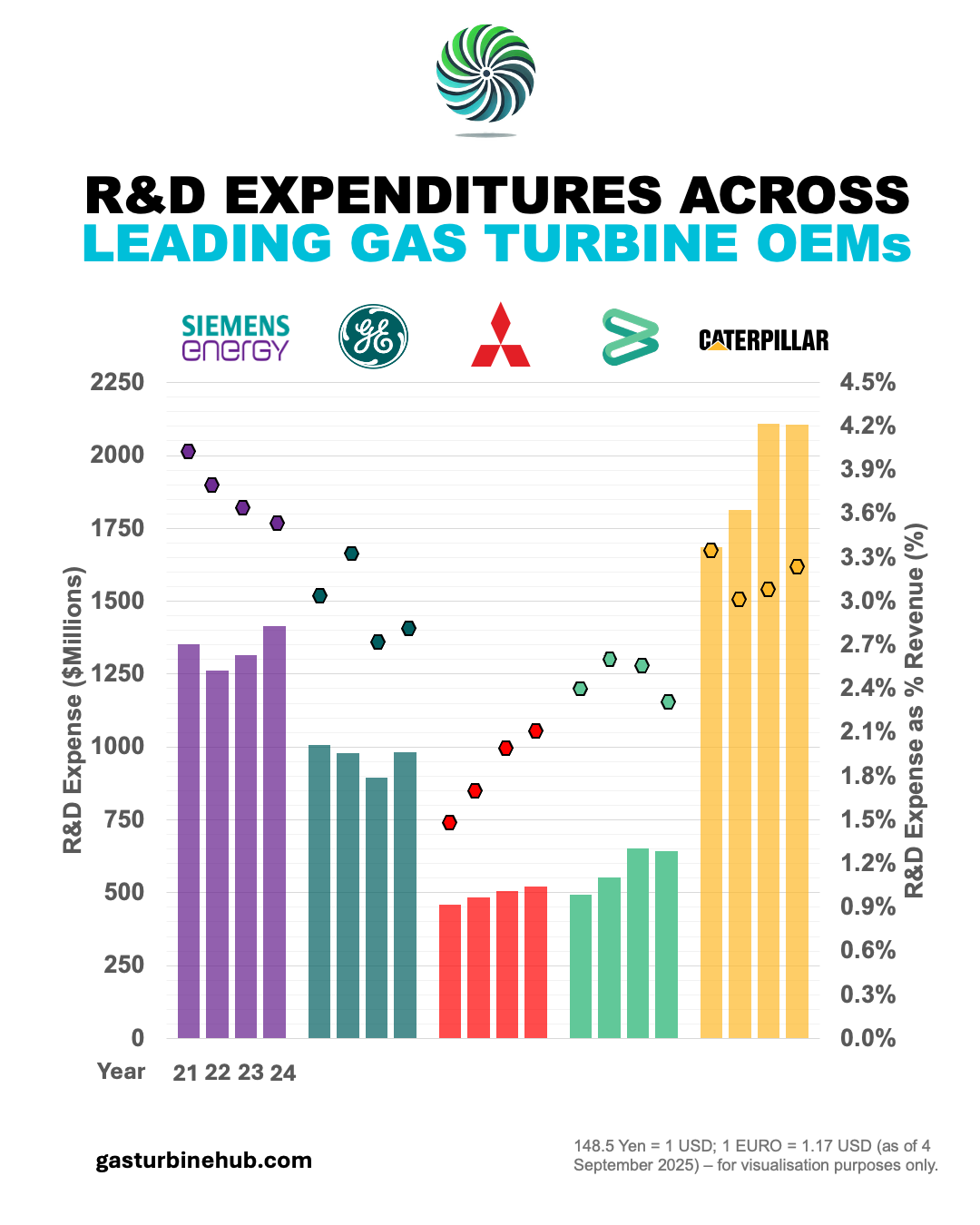

This month’s spotlight visual (see chart below) looks at R&D spending among the world’s leading gas turbine OEMs. At first glance, the bars tell us who is spending the most in absolute terms, but a deeper look at R&D as a share of revenue (dots) raises more provocative questions. Are today’s investments aligned with the innovation challenges ahead—or are OEMs simply coasting on incremental improvements?

Reading Between the Lines

Looking only at absolute R&D expenditures, Siemens Energy and GE appear as leaders, sustaining annual commitments in the $1.0–1.5 billion range. Mitsubishi, by contrast, reports much lower totals, hovering closer to $0.5 billion. Caterpillar stands out for its consistency, with R&D steadily climbing to over $2 billion, though this includes investments beyond turbines.

Yet absolute numbers don’t tell the full story. The percentage of revenue reinvested into R&D is equally important—perhaps even more so. Caterpillar, while impressive in absolute terms, maintains R&D intensity around 3–3.5% of revenue. Siemens Energy and GE, despite stronger order books, have actually seen slight declines in R&D intensity in recent years.

At the other end of the spectrum, Mitsubishi and Baker Hughes stand out for all the wrong reasons: not only are their absolute R&D expenditures the lowest, but so are their reinvestment ratios. While Baker Hughes manages a slightly higher percentage than Mitsubishi, both fall well below the industry’s leaders, raising doubts about how seriously they are preparing for the technological demands of a net-zero future.

This leads to a critical question: Are the biggest OEMs truly reinvesting enough of their revenue into future technologies, or are they coasting on legacy strength?

Let’s take a closer look.

A Critical Perspective

This is where the industry needs honesty. Too much of today’s so-called “R&D” looks like a strategy to:

-

Extend existing platforms with minor upgrades,

-

Lock operators into expensive proprietary service packages, or

-

Push the market toward buying new turbines instead of helping users decarbonize the ones they already have.

That is not innovation. That is business protectionism dressed up as R&D.

For an industry at the center of the energy trilemma—reliable, affordable, and sustainable power—the stakes could not be higher. The gas turbine sector faces challenges on all fronts: decarbonization, hydrogen readiness, digitalization, lifecycle cost reduction, and competition from renewables plus storage.

And yet, with few exceptions, R&D intensity remains under 3.5%. Compare this with the tech sector, where reinvestment rates of 10–15% are standard, or automotive, where the shift to EVs has forced R&D spending above 7%. For an industry tasked with nothing less than reinventing itself for a net-zero future, these numbers look timid.

One could argue the gas turbine OEMs are simply being risk-averse—protecting margins in a volatile market rather than making the bold bets needed to secure long-term relevance. But if not now—when energy security, decarbonisation, and industrial resilience dominate global agendas—then when?

What It Means for Stakeholders

-

For end-users: If OEM R&D is mainly about upselling new hardware or squeezing more service revenue, then innovation aligned with decarbonisation timelines will lag—and you’ll pay the price in higher lifecycle costs.

-

For investors: Low reinvestment ratios may prop up near-term profits, but they undermine long-term competitiveness in a sector that cannot stand still.

-

For policymakers: Don’t be fooled by big absolute R&D numbers. The ratios tell a different story—one that may demand stronger public–private partnerships to ensure the right kind of innovation gets funded.

-

For OEMs: The real risk isn’t overspending on innovation—it’s underinvesting and letting disruptors, whether in hydrogen technology, digital solutions, or hybrid systems, seize the future.

Looking Ahead: The data is clear: absolute spending is not the same as strategic innovation. Too much money is going into protecting installed bases and monetizing service contracts, and not nearly enough into the transformative leaps that will define the next two decades of energy.

If OEMs want to remain central to the energy transition, they must move beyond incrementalism. This means dedicating serious R&D budgets not just to selling the next upgrade, but to enabling operators to run existing fleets cleaner, longer, and more efficiently—while simultaneously developing the architectures that will thrive in a net-zero world.

But let’s be clear: this is not an article written to criticise OEMs. It is a call to raise awareness, to put the numbers front and center, and to recognize that we are all against the clock. The gas turbine community—OEMs, end-users, policymakers, investors—must collectively ensure we strike the right balance across the three pillars of the energy trilemma: reliability, affordability, and sustainability.

The choice is stark: treat R&D as a cost of doing business—or as the lifeline to survival.

Join the Conversation: Sign up for our newsletter to stay updated on developments in gas turbine technology and the energy sector.

The Latest News in a Snapshot

Gas Turbine New Installations

-

Belgium’s 875 MW Flémalle CCGT Begins Operation (Siemens HL Gas Turbine)

“ENGIE’s new gas-fired plant in Flémalle, Belgium (875 MW) had a successful first-fire in August. A Siemens SGT5-9000HL turbine and giant HRSG were installed, replacing an old coal unit. The plant will supply >1 million homes and support grid stability.“

Source: Tractebel-ENGIE (27 August, 2025) -

First new natural gas turbine delivered to Georgia Power’s Plant Yates

“Georgia Power installed the first Mitsubishi Power M501JAC turbine at Plant Yates, its first new gas turbine in 10+ years. Three such turbines (1300 MW total) will be online by 2027 to meet booming demand, with fast 30-minute start capability and dual-fuel operation.“

Source: Mitsubishi Power / Georgia Power (15 August, 2025) -

ACWA, SEC, KEPCO Close on Two Power Plants in Saudi Arabia

“In Saudi Arabia, ACWA Power (with SEC & KEPCO) reached financial close to build two 1,800 MW CCGT plants (Rumah‑1 and Al‑Nairiyah‑1). Equipped with Mitsubishi JAC turbines, these hydrogen-ready plants will add reliable capacity by 2028 in line with Vision 2030 goals.“

Source: Turbomachinery International (26 August, 2025)

Gas Turbine Technology and Market Developments

-

Ansaldo Leverages VR Tech

“Ansaldo Energia reported integrating virtual reality into its gas turbine business for design simulation, workforce training, maintenance support, and customer demos. This update underscored how VR is improving engineering accuracy, technician skills, and client engagement while advancing sustainable operations.“

Source: Ansaldo Energia (1 August, 2025) -

Responding to power demand growth with inlet air cooling retrofits

“As electricity demand continues to increase across the U.S., utilities are looking for ways to get more performance out of their existing generation fleets. Specifically, combustion turbines, critical for delivering firm and dispatchable power, are facing increased operational stress in hotter climates and tighter energy markets. Inlet air cooling (IAC) offers a practical, proven solution for enhancing turbine efficiency and gaining valuable megawatts from equipment already in the field.“

Source: power-eng.com (4 August, 2025) -

‘Engineering Masterpiece’: MAPNA Unveils Indigenous F-Class Gas Turbine MGT-75

“The MGT-75 gas turbine was inaugurated at MAPNA’s Turbine Engineering and Manufacturing Company (TUGA) during a ceremony that highlighted the conglomerate’s key technological achievements on its 32nd anniversary. The F-class MGT-75 competes with leading global turbines—producing 222 MW in simple-cycle and 345 MW in combined-cycle power, achieving efficiencies of over 39.5% and over 59%, respectively, and capable of operating on hydrogen.“

Source: Mapna Group (18 August, 2025) -

GE Vernova plans new $41 million, 50 job investment in Schenectady to expand gas power capacity

“The company plans to hire 50 new employees over the next two years to support growth and rising demand, backed by new investment to expand its Center for Excellence for steam and generator assembly and testing. This funding adds to the $130 million already announced since 2023 in Schenectady, which is expected to generate over 300 jobs, and is further supported by a $1 million Excelsior Jobs Program grant from the State of New York.“

Source: GE Vernova (19 August, 2025) -

Baker Hughes Awarded Long-Term Service Agreement by bp for Tangguh LNG Operations, Supporting Indonesia’s Energy Future

“Baker Hughes has secured a 90-month service contract for bp’s Tangguh LNG plant in Papua Barat, Indonesia. The agreement includes spare parts, repair services, and field-service engineering support for the facility’s turbomachinery—comprising heavy-duty gas turbines, steam turbines, and compressors across three LNG trains. To meet local content requirements, Baker Hughes is partnering with PT Imeco Inter Sarana.“

Source: Baker Hughes (26 August, 2025) -

Essential Utilities to Invest $26 Million in Major Data Center in Western Pennsylvania

“The project involves building a ~18 million gallon per day (MGD) water treatment plant to serve an on-site power plant and data center, with natural gas consultative and energy management services playing a critical role in its development.“

Source: Essential Utilities (27 August, 2025) -

Mitsubishi Heavy to double gas turbine capacity in two years as demand soars

“We were working toward boosting production capacity by 30%, but that’s not enough to meet growing demand,” Ito said. “Fulfilling those orders is our top priority.“

Source: TheJapanTimes (1 September, 2025)

Hydrogen Gas Turbines

-

China Begins Construction on World’s Largest Pure-Hydrogen Power Project in Inner Mongolia

“Construction begins on a 30MW 100%-hydrogen turbine in Ordos, linking wind, solar, electrolysis, hydrogen storage, and green ammonia in a single closed-loop energy system.”

Source: FuelcellWorks (11 August, 2025)

-

Demonstration Tests of Environmental Attributes Management in Hydrogen

Co-firing Power Generation Launched

“Kansai Electric and Kawasaki Heavy Industries launched tests tracking CO₂ emissions from hydrogen co-firing at Himeji No.2 power station. Using green and nuclear-derived hydrogen, they will measure lifecycle emissions in a gas turbine, while MHI evaluates carbon capture on the exhaust.”

Source: Kawasaki (22 August, 2025)

-

China Begins Construction on World’s Largest Pure-Hydrogen Power Project in Inner Mongolia

“Construction begins on a 30MW 100%-hydrogen turbine in Ordos, linking wind, solar, electrolysis, hydrogen storage, and green ammonia in a single closed-loop energy system.”

Source: FuelcellWorks (11 August, 2025)

Carbon Capture and Sequestration Projects

-

HyNet build-out boosts jobs and economic growth to further support carbon capture in the North West and North Wales

“Five projects classified as Priority which includes two new projects of Connah’s Quay Low Carbon Power and Ince Bioenergy with Carbon Capture and Storage (InBECCS) alongside three existing projects; Protos Energy Recovery Facility (Encyclis), Padeswood Cement Plant (Heidelberg Materials), and Hydrogen Production Plant 1 (EETH).“

Source: CCSAssociation (5 August, 2025)

-

OQGN Targets Ibri Power Plant For Carbon Capture In Partnership With Oxy Oman

“OQ Gas Networks (OQGN), the majority state-owned operator of Oman’s gas transportation infrastructure, has identified the 1,509 MW Ibri Power Plant in Al Dhahirah Governorate as a priority site for carbon capture in collaboration with Occidental (Oxy) Oman.“

Source: Carbon Herald (11 August, 2025)

-

First CO2 volumes stored at Northern Lights

“The first CO₂ volumes have now been injected and successfully stored in the reservoir 2.600 meters under the seabed. The world’s first third party CO2 transport and storage facility is now in operation, contributing to reducing European greenhouse gas emissions.“

Source: Equinor (25 August, 2025)

Gas Turbine Related Events Happening in 2025 and 2026

GPPS Shanghai Technical Conference 2025

Date: September 4-6, 2025

Location: Shanghai, China (In-person)

Organizer: GPPS

Website: https://gpps.global/gpps-shanghai25/

Enlit Asia

Date: September 9-11, 2025

Location: Bangkok, Thailand (In-person)

Organizer: Enlit

Website: https://www.enlit-asia.com

Gastech Exhibition and Conference 2025

Date: September 9-12, 2025

Location: Milan, Italy (In-person)

Organizer: Gastech

Website: https://www.gastechevent.com

ASME Gas Turbine India Conference 2025

Date: September 10-13, 2025

Location: Hyderabad, India (In-person)

Organizer: ASME

Website: https://www.asme-india.org/tec/gas-turbine-gt

Turbomachinery & Pump Symposia (TPS) 2025

Date: September 15-18, 2025

Location: Houston, Texas (In-person)

Organizer: TPS

Website: https://tps.tamu.edu

Combustion Turbine Operations Technical Forum (CTOTF) 50th Anniversary Conference

Date: September 21–25, 2025

Location: La Quinta Resort & Club, Palm Springs, California (In-person)

Organizer: CTOTF

Website: https://ctotf.org/home

RoTIC (Rotating Machinery Technology & Innovation) Symposium 2025

Date: September 22-24, 2025

Location: Dubai, United Arab Emirates (In-person)

Organizer: Aldrich International

Website: roticsymposium.com

Wärtsilä Users Group Annual Conference 2025

Date: September 29 – October 2, 2025

Location: Silver Legacy Resort, Reno, Nevada (In-person)

Organizer: Power Users

Website: https://www.powerusers.org/

ETN Global US High-Level User Meeting 2025

Date: October 6, 2025

Location: Houston, Texas (In-person)

Organizer: ETN Global

Website: https://etn.global/events/etn-global-us-high-level-user-meeting-2025/

V94.3A Users Conference 2025

Date: October 6–9, 2025

Location: Dubai, UAE (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com

ETN Global High-Level User Meeting 2025

Date: October 13, 2025

Location: Brussels, Belgium (In-person)

Organizer: ETN Global

Website: https://etn.global/events/etn-global-high-level-user-meeting-2025/

F9FA/FB, F6FA and 9HA Users Conference 2025

Date: October 13–16, 2025

Location: Bucharest, Romania (In-person)

Organizer: GTUsers

Website: https://ssl.gtusers.com

ETN Global 12th International Gas Turbine Conference (IGTC 2025)

Date: October 14–15, 2025

Location: Brussels, Belgium (In-person)

Organizer: ETN Global

Website: https://etn.global/events/igtc-25/

5th European Micro Gas Turbine Forum (EMGTF 2025)

Date: October 15–16, 2025

Location: Brussels, Belgium (In-person)

Organizer: Brunel University / University of Seville / ETN Global

Website: https://etn.global/events/emgtf25/

MEGAWATT

Date: October 21–22, 2025

Location: Milan Bergamo, Italy (In-person)

Organizer: MEGAWATT

Website: https://www.megawattexpo.com

SGT-A35 (Industrial RB211) User Group Meeting 2025

Date: November 4–6, 2025

Location: Pau, France (In-person)

Organizer: ETN Global (Host – TotalEnergies)

Website: https://etn.global/events/sgt-a35-user-group-meeting-2025/

Enlit Europe

Date: November 18–20, 2025

Location: Bilbao, Spain (In-person)

Organizer: Enlit

Website: https://www.enlit-europe.com

GT26 Users Conference 2025

Date: November 10–13, 2025

Location: Istanbul, Turkey (In-person)

Organizer: GTUsers

II Seville Forum on Machinery for Decarbonization

Date: January 20, 2026

Location: Seville, Spain (In-person)

Organizer: University of Seville

Website: https://eventos.us.es/133965/detail/ii-seville-forum-on-machinery-for-decarbonization.html

PROENERGY Annual Conference

Date: January 26–28, 2026

Location: Phoenix, Arizona (In-person)

Organizer: PROENERGY

Website: https://www.proenergyservices.com/about-us/user-conference/

Baker Hughes Annual Meeting 2026

Date: January 28–30, 2026

Location: Florence, Italy (In-person)

Organizer: Baker Hughes

Website: https://annualmeeting.bakerhughes.com

26th Annual 501F & 501G Users Group Conference 2026

Date: February 15–20, 2026

Location: Norfolk, Virginia (In-person)

Organizer: 501F & 501G Users Group

Website: https://forum.501fusers.org/static-pages/page/conference/1

Frame 5 / 6B / 7E / 9E User Group Meeting 2026

Date: February 17–19, 2026

Location: Ludwigshafen, Germany (In-person)

Organizer: ETN Global

Website: https://etn.global/events/frame-user-group-meeting-2026/